Special deals just for you! Limited time only

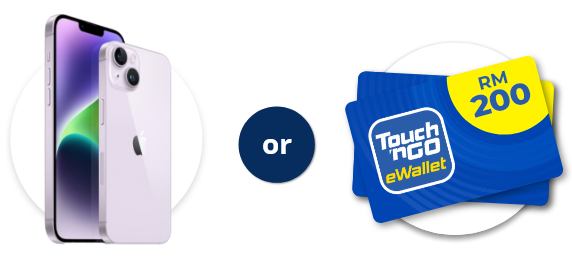

Stand to win an iPhone 14 worth RM 4199 or RM200 TNG eWallet when you apply for HealthInsured or PrimeCare+

Campaign ends 30 September 2023 | Sign Up Gift Terms & Conditions

All-In-One Medical Card

Allianz HealthInsured

Medical coverage designed to give you peace of mind

Most people are striving to live better, healthier lives, especially since medical costs are on the rise. One way to stay protected from health and financial risks is with a medical card. Here are some of the Allianz HealthInsured benefits:

No Overall Lifetime Limit & High Overall Annual Limit of up to RM5 million

Full COVID-19 coverage for categories 3, 4 and 5

Extensive Cancer Coverage including access to genomic testing and extended out-patient cancer treatment cover

All-in-one medical card for treatments without long processing time

Flexible deductible plan with retirement option at age 60

Protection for preborn children (from 13 to 36 weeks)

Why choose HealthInsured?

This policy comes with extra value-added services:

Get exclusive home monitoring service by medical care professionals right from the comfort of your own home via Allianz Care@Home.

Gain access to medical specialists from around the world on treatment recommendations and other medical issues with the International Second Medical Opinion.

Join the Allianz We Care Community to take charge of your health profile, track medication, and find the right medical experts via the exclusive Vivy App.*

Critical Illness Plan

Allianz Prime Care+

Protect yourself from life-threatening illnesses.

Critical illnesses can sometimes be inevitable, hence why Allianz provides extensive coverage for medical emergencies, say you or your loved ones are diagnosed with a critical illness. Here are some of the Allianz PrimeCare+ benefits:

Critical illness coverage up to age 100

Coverage for 7 additional critical illnesses for those below the age of 19

Covers more than 150 critical illness conditions from early to advanced stages

Cancer recovery benefit for early, intermediate and advanced stages

Catastrophic CI benefit with an additional payout should you be diagnosed with any of the six catastrophic illnesses

Angioplasty and Other Invasive Treatments for Coronary Artery Disease**

Why protect yourself with Prime Care+

Covers out of pocket medical expenses such as alternative medicine and medical devices.

Guard yourself against the inability to meet financial obligations like paying off loans, saving for your children’s education, and taking care of your loved ones’ needs.

Protect yourself from financial strain caused by additional expenses such as special dietary needs, rehabilitation and therapy, or hiring a caregiver.

What happens after you apply and fill in your details

You’ll receive a call back from our customer care consultant within 48 hours.

Our customer care consultant will assist you with your application and queries.

Our customer care consultant will help you with any further questions regarding your application.

We’ve helped over 2 Million Malaysians find the right products

Find the right product Get insurance recommendations in just a few clicks.

100% online Apply from your phone or PC, hassle-free with no hidden fees.