Running a business?

Get cash the secure, convenient way.

We’ll help you get the financing you need with fast processing times and flexible terms that you can afford all within 1 week. Use the cash to purchase new stock, expand your business, upgrade or buy new equipment and systems, or even just for working capital.

Once your financing is approved, we offer additional, complementary support in form of advice and solutions with BizSmart Solution and Support Lokal programmes to help grow your business further.

Why choose

Alliance Digital SME?

Get approved in just 3 simple steps

-

Fill out the e-form and submit it together with your MyKad (front and back copy) and a selfie

-

Submit your company’s bank statements (latest 6 months)

-

Attend a virtual interview after your application has been shortlisted

FAQs

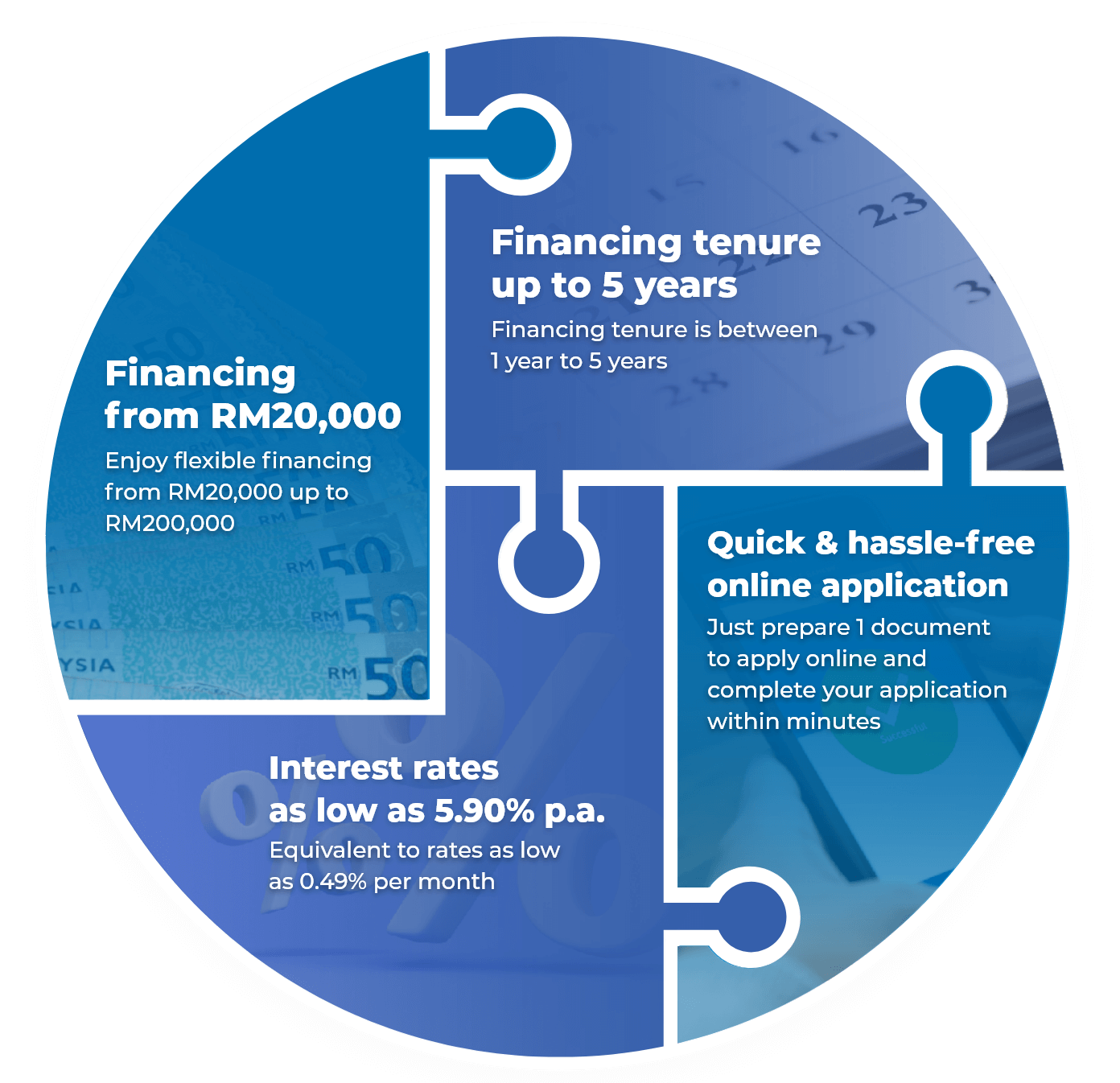

Financing Amount: Any amount from RM20,000 up to RM200,000

Financing Tenure: Between 1 year to 5 years

Interest Rates: Approximately 5.90% p.a. to 13.78% p.a. (flat rate), or equivalent to rates as low as 0.49% per month. The interest rate quoted and/or prescribed by the Bank hereunder is subject to the Bank’s right to vary the same at any time and from time to time with prior notice to you.

Total Interest: Financing Amount (RM) x Interest Rate (%) x Tenure (Years)

Financing Tenure: Between 1 year to 5 years

Interest Rates: Approximately 5.90% p.a. to 13.78% p.a. (flat rate), or equivalent to rates as low as 0.49% per month. The interest rate quoted and/or prescribed by the Bank hereunder is subject to the Bank’s right to vary the same at any time and from time to time with prior notice to you.

Total Interest: Financing Amount (RM) x Interest Rate (%) x Tenure (Years)

✔️ Your business entity must be registered in Malaysia

✔️ Application must be submitted by company director or shareholder

✔️ Business entity must have minimum 51% shareholding by Malaysians

✔️ Latest 6 months company bank statements

✔️ All company shareholders or directors are to be loan guarantors

Stamp Duty: As per the Stamp Duty Act 1949 (Revised 1989).

Documentation Fee: Waived for loans RM100,000 & below. A flat rate of RM500 will be incurred for loans above RM100,000.

Documentation Fee: Waived for loans RM100,000 & below. A flat rate of RM500 will be incurred for loans above RM100,000.

- No collaterals are required.

- Guarantors are required. All company shareholders and directors are required to be guarantors.